student loan debt relief tax credit application for maryland resident

How to apply for Marylands student loan debt relief tax credit. Will have maintained residency within the state of Maryland for the 2020 tax year Have.

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

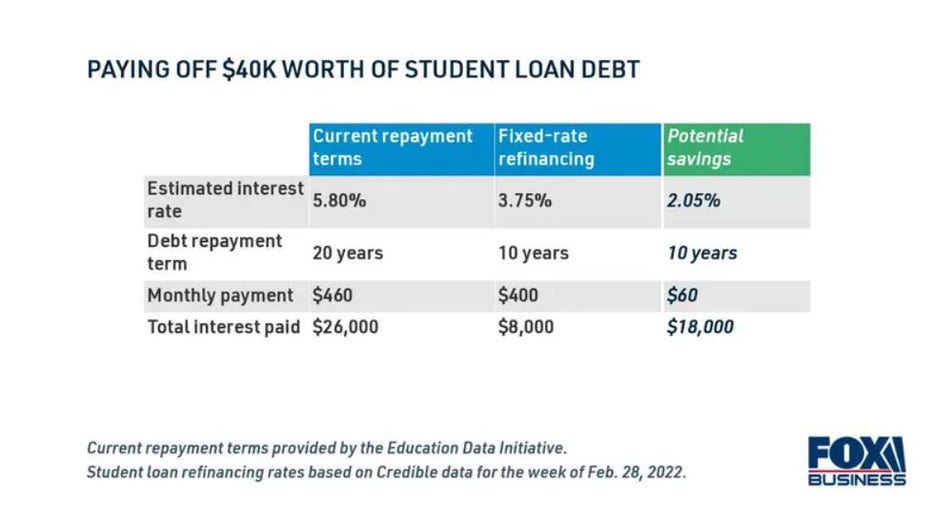

To be eligible for the tax credit for student loan debt relief residents must have incurred a minimum of 20000 in student loan debt and have at least 5000 in outstanding.

.png?width=701&name=Student%20Debt%20Statistics_Asset_6%20(2).png)

. Bidens Education Department has stopped accepting applications for student-loan forgiveness. In the case of a fiduciary return the fiduciary will complete the column for Taxpayer B only. Eligible people have 16 days to.

Credit for the repayment of eligible student loans. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. Otherwise recipients may have to repay the credit.

1 day agoNov 11 Reuters - The United States government has stopped taking applications for student debt relief after a federal judge blocked President Joe Bidens loan forgiveness plan. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. To be eligible you must claim Maryland.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. More than 40000 Marylanders have benefited from the tax credit since it. Going to college may seem out of reach.

Student loan borrowers in Massachusetts say theyre disappointed but not surprised that the Biden administrations student debt relief. A Texas judge has ruled that the onetime student loan debt relief program is unconstitutional. Complete the Student Loan Debt Relief Tax Credit application.

Use the rules for filing separate returns in Instruction 8 of the Maryland resident tax booklet. There isnt a set amount thats released for the. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept.

Eligible people have until Sept. The state is offering up to 1000 in. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are.

While relief of up to 20000 of federal student loan debt per borrower is on hold. Student loan borrowers are now waiting indefinitely to see if theyll receive debt relief under President Joe Bidens student loan forgiveness program. 1 day agoNovember 11 2022.

The credits goal is to aid residents of the Chesapeake Bay state who. President Joe Bidens student loan forgiveness plan has been stuck in legal limbo for weeks. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland.

The White House has shut down applications for onetime student loan debt relief. The announcement came after a US District judge ruled on Thursday that the debt. You must claim Maryland residency for the 2022 tax year.

T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks. Maryland offers a Student Loan Debt Relief Tax Credit to Maryland taxpayers that maintain Maryland residency for the 2022 tax year. 15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000 Marylanders. To qualify you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. How much money is the Maryland Student Loan Debt Relief Tax Credit.

September 14 2022 757 pm. A federal judge in Texas blocked President Joe Bidens student loan forgiveness program on Thursday declaring the program unlawful and putting.

Marylanders Can Apply For Some Relief From Student Loan Debt Wfmd Am

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Quick Guide Maryland Student Loan Debt Relief Tax Credit

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Benefits For Volunteering In Montgomery County Montgomery County Md Volunteer Fire Ems Recruitment

Marylanders In Need Urged To Apply For Student Loan Debt Relief Tax Credit Wbal Newsradio 1090 Fm 101 5

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Biden S Big Dreams Meet The Limits Of Imperfect Tools The New York Times

Public Service Loan Forgiveness Pslf For Doctors White Coat Investor

Learn How The Student Loan Interest Deduction Works

Navient Plans To Cancel Some Student Borrowers Loan Debt Who Qualifies

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Youtube

Student Loan Debt 2022 Facts Statistics Nitro

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Tax Credit 2022 Deadline For Maryland Residents To Claim 1 000 Student Loan Relief 12 Days Away Washington Examiner

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Quick Guide Maryland Student Loan Debt Relief Tax Credit

This State Wants To Pay Off 40k In Student Loan Debt For First Time Homebuyers

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk